Erdem Aydın, RDM Advisory

In the aftermath of another exchange rate shock which saw lira took a 4% nosedive following the central bank’s interest rates cut on Thursday, Ankara is a melting pot. The opposition leaders are confident enough to renew calls for early elections, the country’s leading economists are united in their criticisms, the usually timid business people are increasingly expressive, while Erdogan’s ministers, social media trolls and his enigmatic ruling partner are equally silent. While all the signs of early elections are present, how long can the regime hold its ground? And where and how far can Erdogan go in his measures?

A VICIOUS CYCLE

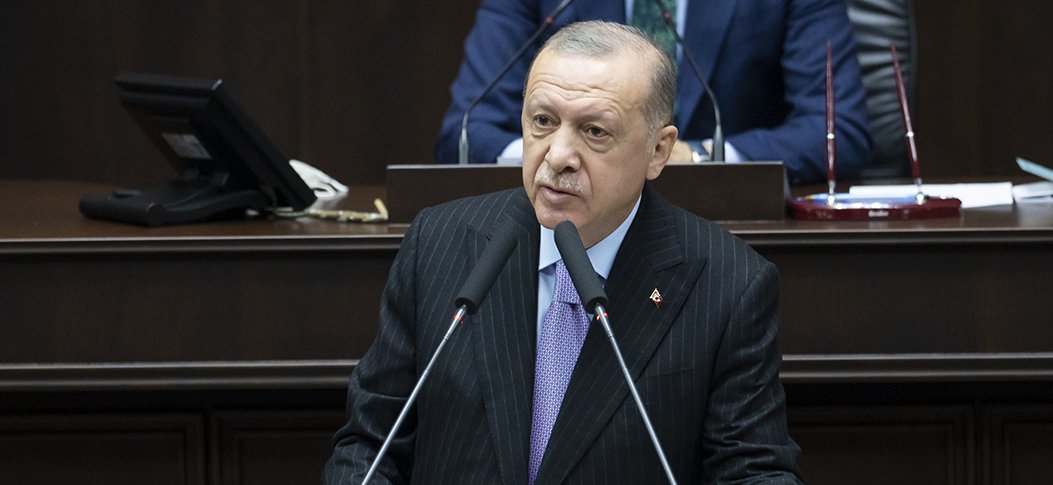

It is a commonplace that Turkish President Recep Tayyip Erdogan holds unorthodox economic views regarding interest rates and inflation. As he has repeatedly stated, including in his speech in the parliament a day before the CBRT’s rates decision on Thursday, he believes that the interest rates are ‘’the cause of inflation.’’[1]

This highly contested theory of his has so far provided no tangible results for the Turkish economy. While Erdogan has kept up preaching his theory, the inflation rate which is –officially- at 20%, continues to bite into Turkish people’s pockets. Actually, these calls have only been counterproductive as they have raised question marks on the CBRT independence, which has had a deteriorating effect on the exchange rate and in turn, caused price rises, especially in imported goods – a vicious cycle.

As a result of this political pressure, combined with a general deterioration of the rule of law and several government-driven international crises, especially with the US, the Turkish lira lost a quarter of its value in 2021 alone.[2]

THE ROAD TO NOVEMBER RISE

Erdogan only emboldened these concerns by sacking CBRT governors, three in 2.5 years, who failed to comply with his directives.[3] Just as Erdogan was getting restless with his latest appointee[4] who was not proceeding with the rates reductions as fast as he wishes them to be, the latest CBRT seat-filler, an Erdogan loyalist, in an effort to save his hold of one of the most precarious jobs in the Turkish bureaucracy, started to deliver.

Thus began lira’s recent nosedive. In October 2021, a 200 base points (bps) cut of the one-week repo rate to 16%, shocked the markets as well as the lira itself, causing 2% loss of value against the US dollar. This latest cut of 100 bps in November 2021 to 15%, done right after a carefully constructed Erdogan speech the day before, only accelerated this trend and the lira sank to a new record low of 11 to the dollar and lost 4% in value.

Capital Economics, a respected economic research consultancy, stated that the lira stood firmly in the ‘’crisis territory’’ and without an ‘’aggressive policy response,’’ there is a ‘’real risk of large and destabilising falls.’’[5] The question remains as to why Erdogan insists on both intervening in CBRT’s monetary policy and in the way he has done, so far. More on that later.

EARLY ELECTIONS ON THE HORIZON?

The decision with what has appeared to be obvious consequences has caused an uproar across the political spectrum. The opposition leaders, including the main opposition party CHP, the nationalist IYI Party and the pro-Kurdish HDP have repeated calls for early elections with a renewed confidence.[6] Head of TUSIAD, a leading business association which Erdogan targeted in the Wednesday speech, spoke against the rates decision in a rare statement saying that ‘’as a country we are getting poorer.’’[7] The leading economists have increased their criticisms saying that the government was taking Turkey ‘’20 years back, back to the parameters it inherited.’’[8]

While criticism mounted, Erdogan’s communication team remained unusually silent, as well as his ministers, pro-Erdogan journalists and even social media trolls. One of them has even questioned the President saying that ‘’I want to think that he has a plan.’’[9] The early dumbfoundedness, later in the day switched to usual attacks against the opposition with comparisons to the pre-AKP era exchange rate crises, albeit in a reserved manner. There was also some late, vague and almost apologetic support from Erdogan’s social media team on the lines of ’Erdogan knows what he is doing.’[10] The silence among the ministers, especially the Minister of Treasury and Finance Lutfi Elvan is also telling. His discontent with the economic policy is no secret as the pro-Erdogan media singled him out for not applauding Erdogan’s interest rates message in the parliament on Wednesday.[11]

What is even more interesting was the attitude of Erdogan’s junior partner the ultranationalist MHP and its enigmatic leader, Devlet Bahceli whom he has to rely on for parliamentary control. When this article was written, no MHP official stated either any support or criticism. It is known that Mr Bahceli has lately been unhappy with the economic situation and made a statement last week which has raised eyebrows in Ankara as it has brought questions about MHP’s continued –and vital- support to Erdogan. Interestingly, Bahceli said that MHP’s democratic responsibility was ‘’to be in the opposition,’’[12] which was later sugar-coated by leading MHP members. However, considering Bahceli’s track record in initiating early elections, the uneasy silence following the rates decision should be read along the recent statement he made - a warning sign to Mr Erdogan.

ERDOGAN’S PRODIGAL ‘DOGMA’ AND WHAT NOW?

Despite the ever shaky political and economic situation, Mr Erdogan seems determined more than ever in his continued interventions to lower the interest rates. Besides the usual intransigence, coveted in his unorthodox theory, Erdogan, on Wednesday took a worrying turn in favour of orthodoxy- only not in economic terms.

While making his usual case for cheap credits, which was the cornerstone of consistent economic growth in early AKP years, Erdogan told his party members in the Parliament that the ‘‘dogma (‘’nas’’ in Turkish) was ‘’explicit’’ and there was nothing anyone ‘’can do about it.’’[13] This religious dogma Erdogan referred to and which the AKP MPs applauded after a brief hesitation, was none other than the Quran and the verses which are perceived to forbid interest rates.

In a rare statement mixing rational economic decisions with religious ‘dogma,’ Mr Erdogan has finally let out his vision or the vision he arrived at for Turkey’s future. It is only a legitimate cause of worry that this rare public address may have implications beyond Turkey’s monetary policy, especially in the run-up to 2023 –or earlier- presidential elections. This statement builds on major moves aimed at appeasing Islamist supporters, such as converting the iconic Hagia Sophia from a museum into a mosque in July 2020.[14]

Further, this also means that Erdogan will not stop at his calls to lower rates and the CBRT governor, to be relevant, will continue to deliver these cuts, further causing discontent among ministers, chiefly the Minister of Treasury and Finance Lutfi Elvan. As the economists rightly suggest, Turkey will have to brace for impact as the country prepares for further rates reductions, resulting in further exchange rate crises and further inflation.

Although the government will try to hold grounds until the 2023 elections, this vicious cycle is likely to crack both Erdogan’s alliance with Mr Bahceli, his own government and most importantly the support among his core base, who are already looking for alternatives in the two opposition parties which was spawned from AKP. The future looks bleak for Mr Erdogan as he has no longer any vision to offer Turkey except for his old friend, political Islam.

[1] https://t24.com.tr/haber/erdogan-faiz-sebep-enflasyon-neticedir-dedi-dolar-tl-10-48-i-asti,993995

[2] https://www.reuters.com/world/middle-east/turkish-lira-hits-new-depths-near-10-dollar-2021-11-11/

[3] https://www.reuters.com/article/us-turkey-cenbank-governor-idUSKBN2BD0BB

[4] https://www.reuters.com/world/middle-east/exclusive-erdogan-is-cooling-his-latest-central-bank-chief-sources-say-2021-10-08/

[5] https://www.capitaleconomics.com/clients/publications/emerging-europe-economics/emerging-europe-economics-update/lira-sell-off-and-lessons-from-other-sudden-stops/?tk=0711c6ea2ef1fc4b67fc42aa8bbcb0cf12d67e4d&utm_source=Sailthru&utm_medium=email&utm_campaign=Emerging%20Europe%20Economics%20Update%20181121&utm_term=ce_updates

[6] https://twitter.com/kilicdarogluk/status/1461290732577333254?s=20 ;

https://twitter.com/meral_aksener/status/1461336076476366855?s=20 ; https://m.bianet.org/bianet/siyaset/253539-hdp-secim-surecine-girmek-zorunluluktur

[7] https://twitter.com/SimoneKaslowski/status/1461354498945814540?s=20

[8] https://twitter.com/ugurses/status/1461337190437425153?s=20

[9] https://twitter.com/teomandragonov/status/1461329971167834120?s=20

[10] https://twitter.com/icesur/status/1461392878555607040?s=20

[11] https://www.milligazete.com.tr/haber/8302475/erdogan-elvan-gerginligi-lutfi-elvan-istifa-mi-edecek

[12] https://www.karar.com/guncel-haberler/bahceliden-ilginc-cikis-mhpnin-demokratik-sorumlulugu-muhalefettir-1638960

[13] https://www.yenisafak.com/gundem/cumhurbaskani-erdogandan-cok-net-faiz-ve-enflasyon-mesaji-faizi-savunanla-beraber-olmam-3711981